A recent settlement announcement in the antitrust suit against the National Association of Realtors® will bring about some changes in the way buyers are represented. Unfortunately for buyers they will either go unrepresented or be expected to pay for their agent. This is a very poor decision and the court has made an egregious error. However the settlement has not yet been approved but the judge. Here is a link to an article about the recent announcement.

Evergreen Coastal Living

Tuesday, April 2, 2024

Tuesday, January 2, 2024

Happy New Year!

Well here we are in 2024! The outlook for the year is showing signs of relief for weary borrowers as interest rates have soften up a bit. The stock market has seen some nice upticks as well. Maybe 2024 will usher in some good news economically for a change.

Along the SW Washington coast prices saw a steep increase in 2023, but remains well below the prices for similar coastal properties in Clatsop County, Oregon. Despite the loft price tags the Long Beach Peninsula remains the best deal for properties close enough to the ocean to hear the sea roar. Even if we see a decline in prices along the I-5 corridor, which is a strong possibility, I feel there will be continued upward pressure on the peninsula as retirees flock tot he area from more expensive markets.

We shall see how this all plays out as the shiny new year progresses.

Wednesday, November 8, 2023

Market Crash?

Originally posted in Rod's Real Estate News, Nov 3, 2023

Some doomsayers are predicting another serious market correction is eminent. Now this is certainly a possibilty. Many of the conditions that precipitate a market correction are in fact in place right now.

- Slightly higher than average lending rates.

- Tightening of consumer credit by large lending institutions.

- Below average pool of qualified buyers.

- Hyper inflated prices after long aggressive rise.

- Unstable economic conditions.

- Extremely tight inventory levels driven by owners married to a low interest rate.

- High positive growth rates as more people moving in than out (Local Clark County).

- Continued high demand for rentals with inflated rental rates.

- Unstable conditions in other markets can drive investors back to real estate.

- High interest rates attractive to institutional investors buying mortgage paper.

- High overall quality of existing mortgage debt. Minimal sub-prime paper.

- Strong local economy helps us locally.

Tuesday, October 3, 2023

Possible Sunshine in the Rates Next Year!

Originally posted in Rod's Real Estate News, September 29th, 2023

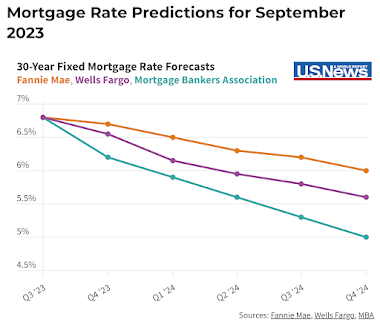

According to US News and World Report the trend for the next few months is a softening in rate pressure. Rates should start to ease a bit providing some relief for weary buyers that have been priced out of mortgages over the last couple years. Locally rates have been running at nearly 8% well above the national average. The chart below shows the national trend and the rates on the chart or prior to any fees or points that banks are in fact charging. Rates that borrowers are actually seeing or will see based on this chart would be 0.5% to 1% higher. Rates also vary based on the lending program, down payment amount, credit profile and other important financial details of the borrower. The good news is they seem to think it is starting to trend favorably for borrowers.

Tuesday, September 5, 2023

Mortgage Rates hit 20 Year High

Originally posted on Rod's Real Estate News August, 2023

That sounds like an ominous thing. It really isn't as bad as it sounds however. The last 20 year cycle saw the lowest 30 year mortgage rates in the history or 30 year mortgages. We spent most of the last 15 years with rates under 5.5% So the headline sounds terrible, which is why every news outlet is running this very headline. They however do not take the time to cover the context, so I'll do that for you here.

According to Bankrate.com over the last 50 years the average mortgage rate has been 7.81% Yes 7.81%. During that 50 year period we had both the highest and lowest 5 year stretches ever recorded. From 1980-1985 the average rate was 14.32% From 2017-2022 rates average 4.17%. Here we sit today with a national average mortgage rate at 7.09% well under that 50 year average but painfully higher than the recent lows of just a couple years ago.

The rates had a rather rapid climb and that creates a psychological shock which tends to makes things seem worse that they really are. Sure many homeowners have decided to stay put and enjoy their 2.9% 30 year mortgage they got back in 2021. This has created a scenario whereby there is a lack of homes for sale at a time when we should see lots of activity. Generally the period immediately after a rapid rise in home values leads to a bit of an equity grab as people sell their homes and move up or downsize. We are not seeing that nearly as much as we should. This may actually be staving off a market correction that should have happened right about now.

So the good news is home values are holding up well, the bad news is, it is tougher to buy in to this market right now. don't let a 7% mortgage scare you away from buying a home. It may limited your buying power but rates will come back down and an opportunity to refinance into a lower rate will arise in the future.

Tuesday, July 4, 2023

Happy Birthday America!

|

| photo from Long Beach website |

This is one of those bucket list items you gotta experience at least once.

Tuesday, June 6, 2023

A revisit to State Parks

Originally posted here in 2020 by Rod Sager,

Did you know that SIX state parks reside in Pacific County on the Long Beach Peninsula Area? That's a fair number and from the mouth of the mighty Columbia up the peninsula to Leadbetter you can dive into the wilds of nature or wonder at the historical buildings of Cape Disappointment and Fort Columbia. There's more to an outing at the coast than a walk on the beach.

Check out the six parks at the beach.

- Cape Disappointment

- Fort Columbia

- Leadbetter Point

- Pacific Pines

- Loomis Lake

- Willie Keils Grave

March is here and soon the weather will turn the corner to spring. For now it is still a bit of winter but sunny days are ahead with late evening sun. Next month the Razor Clam Festival returns so keep your calendar clear.