Originally posted in Rod's Real Estate News, September 29th, 2023

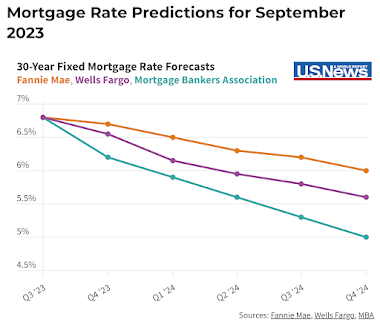

According to US News and World Report the trend for the next few months is a softening in rate pressure. Rates should start to ease a bit providing some relief for weary buyers that have been priced out of mortgages over the last couple years. Locally rates have been running at nearly 8% well above the national average. The chart below shows the national trend and the rates on the chart or prior to any fees or points that banks are in fact charging. Rates that borrowers are actually seeing or will see based on this chart would be 0.5% to 1% higher. Rates also vary based on the lending program, down payment amount, credit profile and other important financial details of the borrower. The good news is they seem to think it is starting to trend favorably for borrowers.

Well let's hope they are right. I do not expect a return to the ridiculously low rates of a few years ago. That was unprecedented. The 50 year average has been around 6.5% and I find that the market responds well to rates under 6%. If we can get rates back into the mid 6s the real estate market will come around. Right now we are in a stalemate as we have neither allot of buyers nor allot of sellers. Pricing is stable but softening and transactions are way down as a result of inactivity. Sellers are holding on to the low rate they have now and buyers can't afford the high rates currently available.

This trend if it materializes could be good for current buyers. Sellers are getting motivated and that means a negotiating edge for buyers. Buyers may find themselves able to refinance their 8% purchase not in a year or so at a more comfortable rate in the 6s.

If that chart holds up, things should perk up a bit next spring.