Originally posted in Rod's Real Estate News, Nov 3, 2023

Some doomsayers are predicting another serious market correction is eminent. Now this is certainly a possibilty. Many of the conditions that precipitate a market correction are in fact in place right now.

- Slightly higher than average lending rates.

- Tightening of consumer credit by large lending institutions.

- Below average pool of qualified buyers.

- Hyper inflated prices after long aggressive rise.

- Unstable economic conditions.

These are all indicators of an eminent market correction. However there are also several counter conditions that are keeping the market stable in spite of the above bullet points. This certainly applies to our local market if not the market nationally.

- Extremely tight inventory levels driven by owners married to a low interest rate.

- High positive growth rates as more people moving in than out (Local Clark County).

- Continued high demand for rentals with inflated rental rates.

- Unstable conditions in other markets can drive investors back to real estate.

- High interest rates attractive to institutional investors buying mortgage paper.

- High overall quality of existing mortgage debt. Minimal sub-prime paper.

- Strong local economy helps us locally.

So the real news is that there is no news. Other economic conditions need to change for a traditional "crash" type correction. What we are witnessing right now is a very soft landing with prices flat or ever so slightly declining.

For buyers the decision should really be based on how long they intend to live in the house they might buy. If someone buys a house today and then decides or must sell it a year later, that is not a favorable situation and renting would definitely be the better option. In an uncertain market with a high probability of at least a modest correction I would recommend a five year commitment to any house purchase din the current market.

I do not think a major hard crash like we saw in 2009-2012 is eminent. That situation was much bigger than real estate. Banks had been making really sketchy loans for over a decade and that led to a near collapse of the banking system. Those aggressive types of loans have been almost non-existent since the federal revisions were made by Congress in 2011.

I'll play Devil's advocate and suggest that we have a repeat of 2009. What would that look like? Well suppose buyer Jones bought a house in 2008 for $300,000. By the time the market hit bottom around 2012 the house was worth about $175,000. Not good, not good at all if you had to move. The house returned to $300,000 in value around mid to late 2014. For the sake of being conservative let's say it was 2015. That is a seven year period from top to bottom and back to par. That my friends was the worst real estate crash since 1929 and the Great Depression. There is no reason that couldn't happen again, but it is extremely unlikely.

Buyers willing to commit to a five year stay can rest assured that barring a catastrophic economic failure, they would be in position to sell with enough proceeds to clear the note and exit the property at the end of that period with maybe the exception of putting less than 5% down. Low down borrowers should add a year or two to the commitment window just to be safe. But in a mild correction even low down and no down borrowers would be able to sell and clear the bank note after five years.

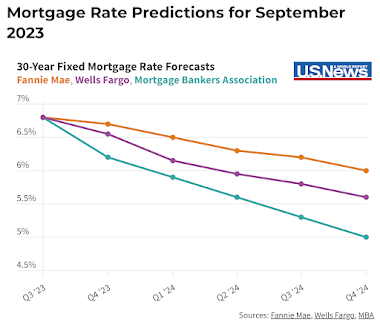

In general I wouldn't let higher rates or the threat of a possible correction stop me from buying a home so long as I am prepared to stay in that home for a minimum of five years. When rates settle down, and they will settle down eventually, buyers will have an opportunity to refinance the loan into a lower rate and save money in the long run.